Why Small Brands Are Moving Away From Alibaba in 2025

For years, Alibaba’s vast B2B platform promised seamless global sourcing. In 2024, it processed over $50 billion in orders. Yet, many U.S. small-business owners now describe a steep hidden cost. Complaints about “payment fraud, poor quality goods, and unexpected price hikes” have become commonplace. Recent U.S. tariff hikes, now reaching 104% on many Chinese imports, have only intensified these issues, with brands citing “higher costs” and “longer shipping times” as critical challenges. What once seemed like a bargain sourcing option now often feels opaque and unreliable. Many emerging fashion and lifestyle brands are discovering that Alibaba’s low prices mask quality and communication problems that damage brand reputation.

Alibaba’s Sourcing Frustrations

There is growing evidence why “mom-and-pop” brands are reconsidering Alibaba. Industry experts and founders point to several pain points:

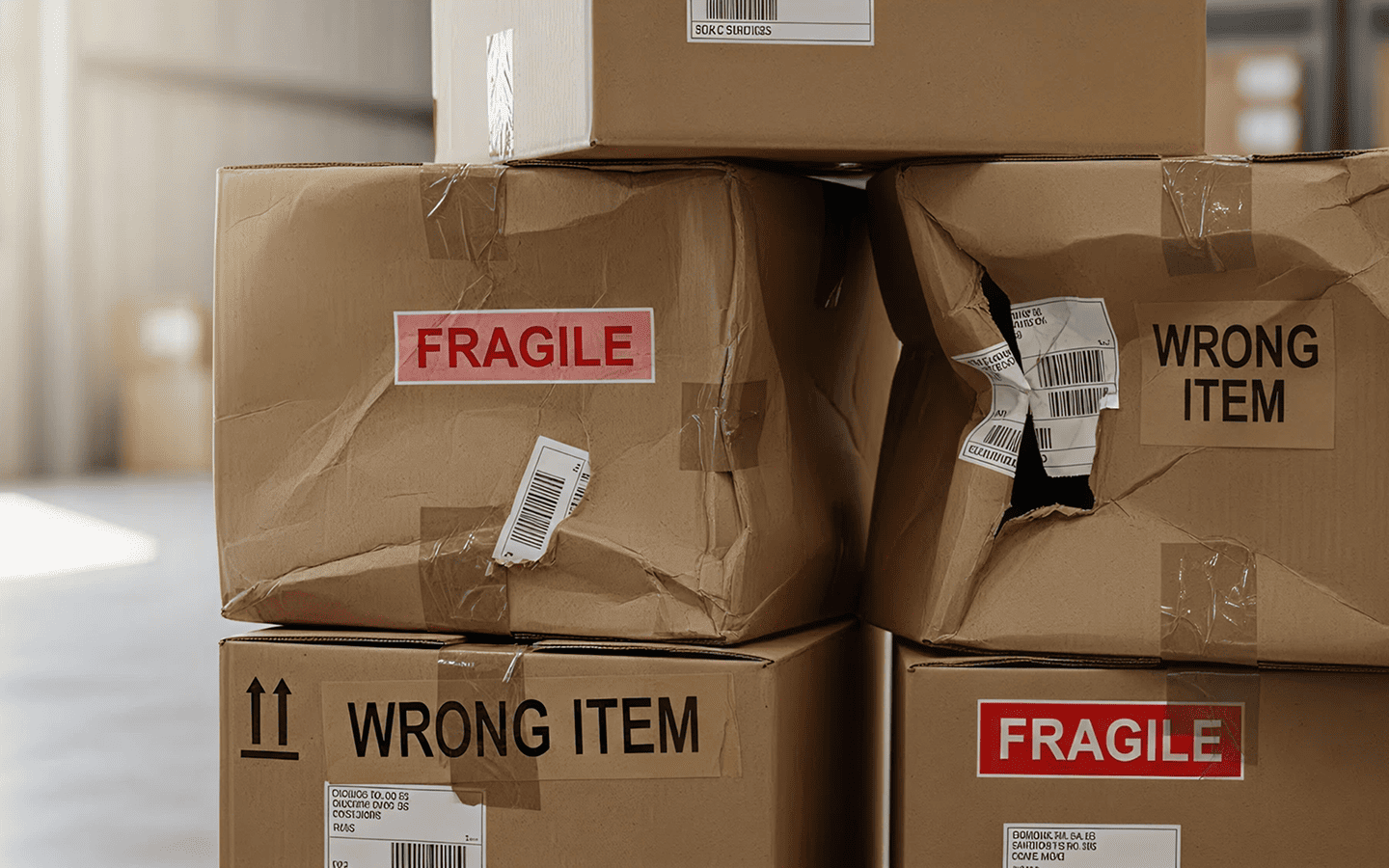

Quality and consistency issues: StartupBros highlights the frequent risk of receiving “poor quality goods or the wrong items.” Alibaba’s product descriptions and photos can be misleading, resulting in substandard products. Small brands rely on dependable quality control, and when trade assurances fail, bad batches or returned goods can devastate a small operation.

Hidden costs and unpredictability: Many suppliers lure buyers with low quotes but add unexpected fees later. StartupBros reports sellers inflating prices or shipping costs just before finalizing orders. With new U.S. tariffs increasing costs by an estimated 54%, entrepreneurs face shrinking margins as tariffs and shipping surcharges turn profits into losses. Many small brands are now “pivoting to domestic suppliers” to avoid these surprises.

High minimum orders: Alibaba vendors often require minimum order quantities (MOQs) in the hundreds or thousands—beyond what young brands can afford. Some suppliers demand $20,000+ upfront for inventory that may not yet sell. In contrast, domestic makers like THE/STUDIO offer orders starting as small as a single sample, appealing to boutique brands.

Intellectual property and counterfeit risks: Designers face risks of IP theft with Alibaba. Experts warn of “patent infringements and counterfeit products.” Any image or logo sent overseas may be copied or resold by another seller, threatening niche designers’ creative control.

Communication and transparency gaps: Working with distant factories means slow responses, language barriers, and little oversight. China trade experts describe supplier communication as “complex” due to “language barriers and cultural differences.” Inquiries often go unanswered during holidays, and brands cannot easily get clear status updates. Alibaba offers limited transparency about who actually makes products, leaving brands in the dark about timelines, factory conditions, or accountability. This lack of visibility is unsustainable for companies needing quick turnarounds.

In short, Alibaba’s low-cost wholesale model from unverified suppliers is failing new brands. Surveys show companies are “shifting investment away from China” and building region-specific supply chains. In 2025, many startup founders facing repeated challenges are seeking alternatives that guarantee quality, responsiveness, and flexibility.

A More Transparent, Brand-Friendly Alternative

Fortunately, a new generation of custom manufacturing platforms has risen to meet modern small brands’ needs. THE/STUDIO, a U.S.-based on-demand production service, exemplifies this shift. Its mission is to empower clients to “manufacture inspiring custom products with low MOQs, talented designers, and amazing factories” all in one platform. Founders can upload artwork, receive quick samples, and order small batches with end-to-end support.

Unlike faceless marketplaces, THE/STUDIO acts as a true partner. Brand owners collaborate directly with in-house designers and vetted U.S./North American manufacturers, receiving real-time feedback. They review digital mockups and physical proofs before production, a stark contrast to risking hundreds of unknown Alibaba samples.

This integrated model addresses Alibaba’s pain points:

Orders ship from U.S. or allied factories, avoiding tariff surprises and long transit times.

Quality checks are built-in; production pauses until customers approve samples.

Direct communication ensures quick, clear responses.

The platform supports extremely low MOQs, even single units allowing brands to test, pre-sell, and iterate without massive upfront risk.

THE/STUDIO flips Alibaba’s model on its head: transparency, personal support, and true custom production replace generic supplier catalogs.

Brand Success Stories

Real brands attest to THE/STUDIO’s value. Indie designer Tommy Breeze partnered with THE/STUDIO to produce embroidered patches and hats, vetting every color and stitch to maintain artistic integrity, a feat nearly impossible on Alibaba. Non-profits and niche marketers appreciate sample approval, order flexibility, and clear timelines. Many praise the platform’s US-based support and real sample proofs.

With THE/STUDIO, brands gain control and confidence. They can scale gradually ordering 10, then 100, then 1,000 units without huge upfront commitments. This collaborative, on-demand approach accelerates turning ideas into products.

Conclusion

By 2025, the pendulum has swung. U.S. entrepreneurs prioritize transparency, quality, and flexibility, even at a slightly higher cost. THE/STUDIO’s custom manufacturing model, combined with talented designers and American factories, enables small brands to launch confidently. Instead of hoping overseas suppliers meet specs, founders see every proof, get early samples, and watch their vision come to life.

This trend reflects a broader shift: as tariffs impact dropshipping, many businesses are transitioning to U.S.-based suppliers for faster, stable production. Modern manufacturing is no longer about hidden factories behind email chains, it’s about collaborative, localized production that keeps brands agile and in control.

With solutions like THE/STUDIO, small brands focus on building their vision, not chasing unreliable suppliers.